Basic Policy

The Pigeon DNA and the Pigeon Way

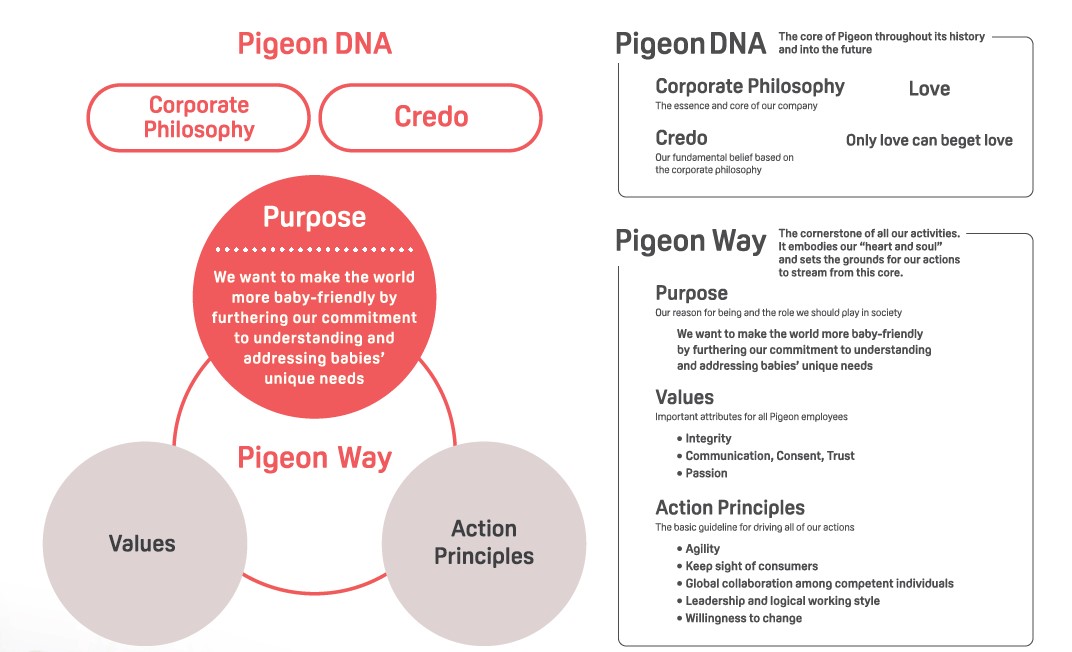

Our corporate philosophy “Love” and the credo “Only love can beget love” are the core of Pigeon. These are the unchanging spirit that each and every Pigeon employee and executive will uphold into the future as the Pigeon DNA, as long as Pigeon continues to exist as an essential part of society.

Our Purpose “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs” and Values and Action Principles that employees and executives should cherish to realize the Purpose are collectively called the Pigeon Way, the cornerstone of all our activities. The Pigeon Way embodies our “heart and soul” and sets the grounds for our actions to stream from this core.

We have reclassified our corporate philosophy and the credo as the Pigeon DNA, the underlying concept of the Pigeon Way. We will continue to drive our business activities toward the realization of the Purpose, positioning it as the core of the Pigeon Way. The Pigeon DNA and the Pigeon Way are defined as follows.

Establishment of Key Issues

Pigeon’s Purpose “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs” cannot be achieved solely through the efforts of Pigeon Group employees and executives, but through collaboration with external stakeholders, including customers, business partners, shareholders, and local communities. We believe that by realizing our “Purpose,” we can not only continue to be recognized as an essential part of society, but also contribute to the creation or realization of a sustainable society that is the basis for coexistence with our stakeholders. In this sense, our underlying Pigeon DNA and the Pigeon Way, the social and environmental challenges we must address, and the future vision we should aim for by addressing the challenges must be shared not only with Pigeon Group employees and executives, but also with our customers, business partners, shareholders, local communities, and other external stakeholders.

Therefore, the Company established the following five (5) Key Issues to be addressed and realized in the process of achieving Pigeon’s Purpose “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs” so that we can share the same mindset with all stakeholders.

Pigeon's Basic Policy of Corporate Governance

Our corporate governance must be based on the Pigeon DNA and the Pigeon Way, be directed toward solving and realizing the Key Issues, contribute to the creation and realization of a sustainable society, and ultimately realizing the Purpose “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs.”

Based on this approach, we define the Company’s corporate governance as follows: 1) Offensive governance: a mechanism for transparent, fair, prompt and decisive decision-making to enhance Pigeon Group’s sustainable growth and medium- to long-term corporate value (societal value and economic value), for the resolution and realization of the Key Issues, and ultimately the realization of the “Purpose”; and 2) Defensive governance: a mechanism for risk control through timely collection and sharing and review and verification of information aimed at prevention and prompt elimination of factors that could hamper Pigeon Group’s sustainable growth and damage its corporate value, or impede the resolution and realization of the Key Issues and the realization of the “Purpose.”

By continuously strengthening these mechanisms, we aim to further enhance corporate governance, increase our corporate value, and ultimately contribute to the creation and realization of a sustainable society, as well as realizing the “Purpose.”

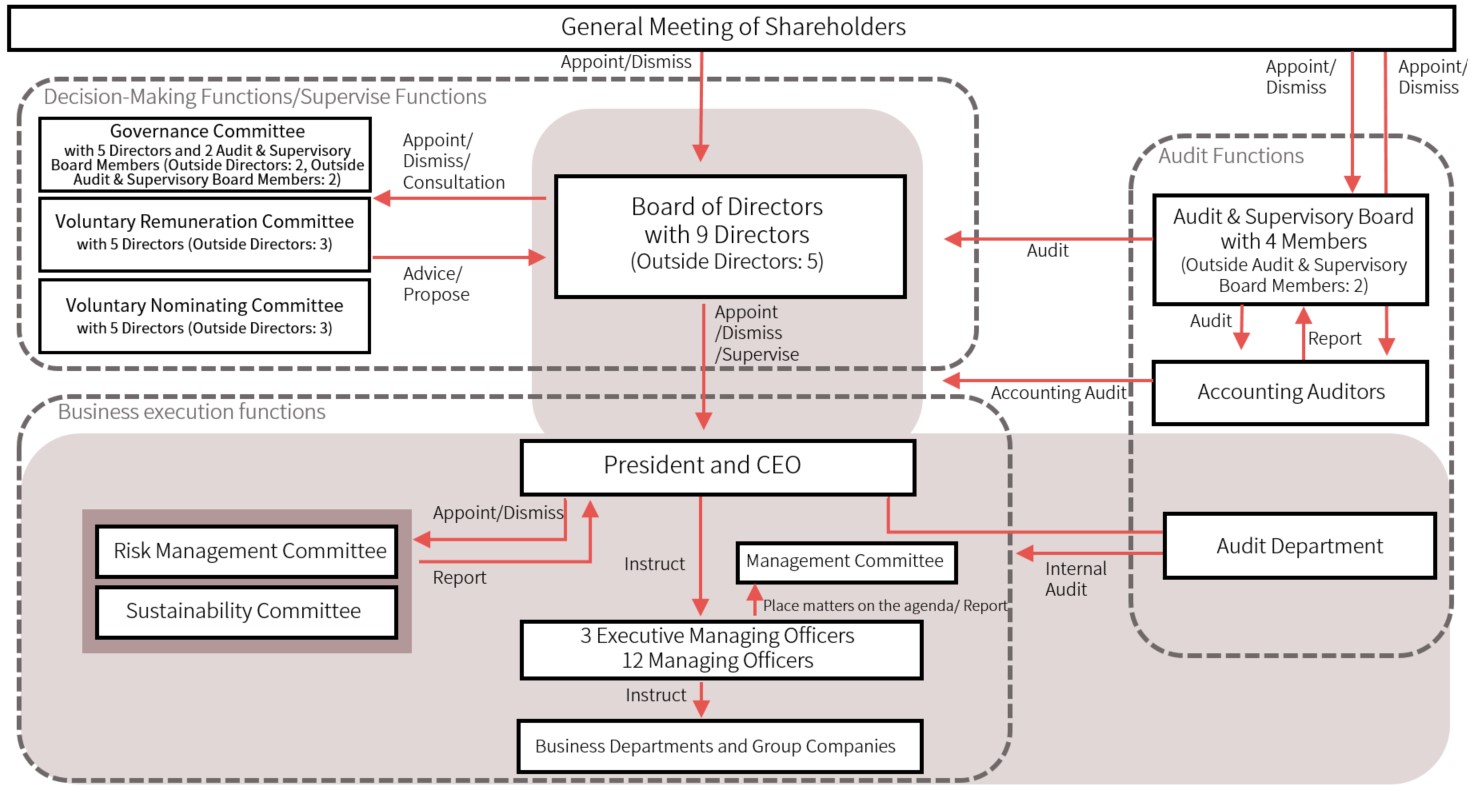

Corporate Governance Organization Chart

Corporate Governance Report

Outline of the Governance System

The Company adopts the system of a company with Audit & Supervisory Board Members and has made rigorous legal audits by Audit & Supervisory Board Members the basis of compliance management. The primary management structures (meeting bodies) are: The Board of Directors comprised of 9 members (six men, three women; eight Japanese nationals, one foreign national) including five Independent Outside Directors; the Audit & Supervisory Board comprised of four members (three men, one woman; four Japanese nationals) including two Outside Audit & Supervisory Board Members; Management Committee headed by the President and CEO and comprised of standing Directors and Senior Managing Officers. The Company is working to enhance the diversity of each of the meeting bodies. In addition, the Company adopts a mandatory executive officer system to provide for mutual partnership between decision-making and oversight (governance) with business execution and to clarify the operating responsibilities of Directors.

The Board of Directors makes decisions on matters (management objectives and important business-execution strategies such as the management strategy) prescribed in laws and regulations, the articles of incorporation, and the “Board of Directors Rules” based on its authority to supervise the execution of duties of directors and managing officers. The Board of Directors actively elicits the opinions of Outside Directors and Audit & Supervisory Board Members, and the supervisory function of the Board of Directors has been further strengthened by having an Independent Outside Director serve as Chairman of the Board from March 2023. Also, in addition to the Voluntary Nominating and Remuneration Committees chaired by and with a majority consisting of Independent Outside Directors, we established the Governance Committee in 2021 as an advisory panel to the Board of Directors. The Governance Committee is headed by an Independent Outside Director and is comprised of a majority of Outside Directors and Audit & Supervisory Board Member.

Audit & Supervisory Board Members attend meetings of both the Board of Directors and the Management Committee, where they deploy their experience in the field to swiftly resolve issues. In addition to enhancing the supervisory function through expression of opinions and the like, Audit & Supervisory Board Members listen to directors, view important resolution documents, examine the current status of business and financial assets, and otherwise conduct meticulous supervision and oversight in accordance with Pigeon’s policies on auditing and allotment of duties. They also meet regularly with the President and CEO, receive reports on matters such as important company issues, and carry out frank exchanges of opinions.

Under the current management structure, centered on the Board of Directors, Audit & Supervisory Board, and Management Committee, Pigeon is working to improve corporate governance by expanding the diversity of the Board of Directors through the appointment and increase of Outside Directors, establishing the Nominating Committee, Remuneration Committee, and Governance Committee as advisory panels to the Board of Directors, and by actively exercising the supervisory function of the Audit & Supervisory Board.

Directors and Management Officers

List of Directors and Management Officers

Skill Matrix

For the story of how we set the "Expertise demanded of the Board of Directors" in the table below, please see here.

| Name | Position | Expertise demanded of the Board of Directors(*1) | Committee members ◎chairman 〇member |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Management, business strategy | Experience in the company, industry experience | Global business | Design, R&D, product development | SCM*2 | Marketing, branding | Human capital, corporate culture | Finance, accounting | Law, compliance, risk management | Solving societal issues | Nominating | Renumeration | Governance | |||

| Directors | Norimasa Kitazawa | President & CEO | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Tadashi Itakura | Director, Senior Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||

| Kevin Vyse-Peacock | Director, Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||||

| Ryo Yano*3 | Director, Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||||

| Rehito Hatoyama | Outside Director*4 and Chairman of the Board |

〇 | 〇 | 〇 | 〇 | 〇 | ◎ | ||||||||

| Takayuki Nitta | Outside Director*4 | 〇 | 〇 | 〇 | ◎ | ◎ | |||||||||

| Chiaki Hayashi | Outside Director*4 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||

| Eriko Yamaguchi | Outside Director*4 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||||

| Yumiko Miwa | Outside Director*4 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||||

| Audit & Supervisory Board Members | Hiroshi Nishimoto | Audit & Supervisory Board Member | 〇 | 〇 | |||||||||||

| Koji Ishigami | Audit & Supervisory Board Member | 〇 | 〇 | 〇 | |||||||||||

| Koichi Otsu | Outside Audit & Supervisory Board Member*4 | 〇 | 〇 | 〇 | |||||||||||

| Atsuko Taishido | Outside Audit & Supervisory Board Member*5 | 〇 | 〇 | 〇 | |||||||||||

*1: A maximum of five main areas of expertise are presented for each person.

*2: SCM: Supply Chain Management

*3: Mr. Yano was elected and has taken office at the 66th Ordinary General Meeting of Shareholders, held on March 30, 2023.

*4: Independent directors based on the regulations of the Tokyo Stock Exchange

*5: Independent directors who satisfy the requirements for an independent director based on the regulations of the Tokyo Stock Exchange

Members and Attendance Status of Board of Directors, Board of Audit & Supervisory, and Committees

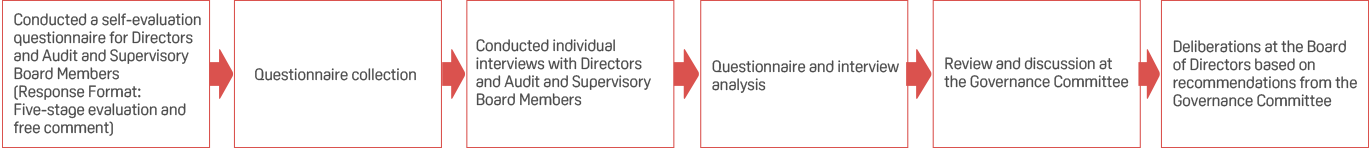

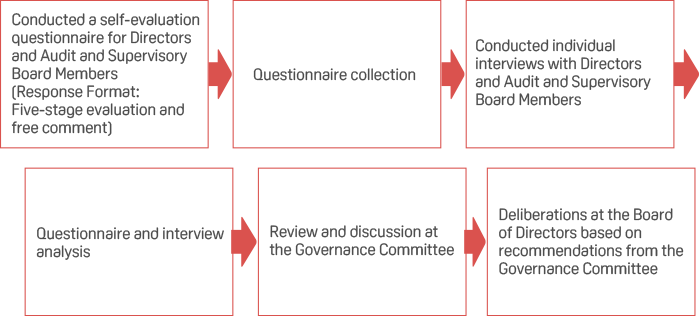

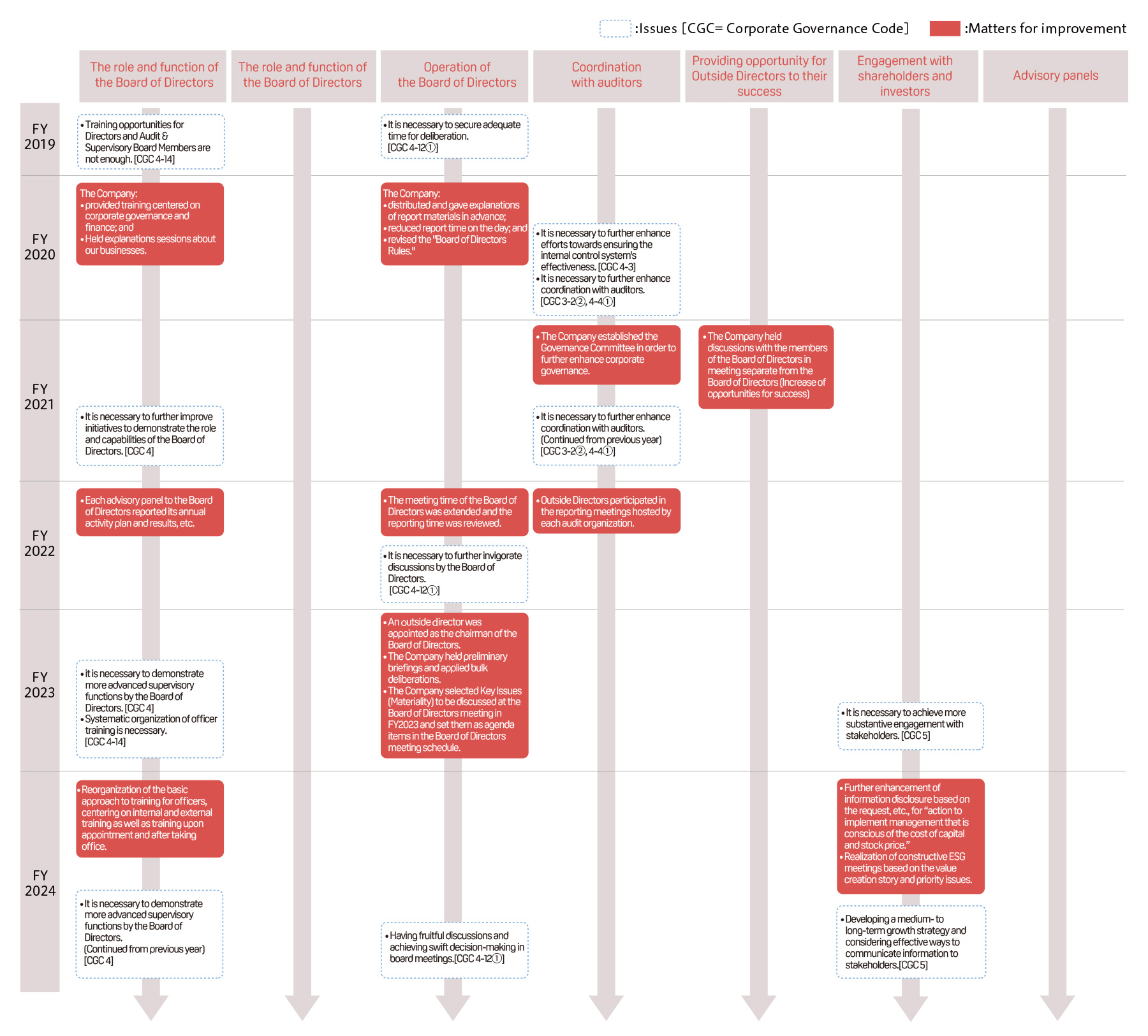

Evaluating the Effectiveness of the Board of Directors

The Company conducts an annual evaluation of the effectiveness of the Board of Directors in order to strengthen it and improve its governance.

Regarding the effectiveness evaluation and analysis methods implemented in FY2023

【Implementation period】Oct. to Nov. 2023

【Respondents】Directors and Audit & Supervisory Board Members (total 13 people)

【Questionnaire items】

Regarding FY2022 issues, FY2023 evaluation result and issues, and Future efforts

|

Issues identified at the FY2022 evaluation |

The Company set the following issues to be addressed in the future to realize the Purpose of the Pigeon Way. ・Continuous operational improvements aimed at further invigorating discussions by the Board of Directors, such as strengthening discussions and progress checks on Key Issues (Materiality). |

|---|---|

|

Initiatives in FY2022 |

The Company continuously addressed operational improvements aimed at further invigorating discussions by the Board of Directors, focusing on the following: ・Selected Key Issues (Materiality) to be discussed at the Board of Directors meeting in FY2023, set them as agenda items in the Board of Directors meeting schedule in advance, and discussed them. ・With the appointment of an outside director as the chairman of the Board of Directors, we secured time for discussion at the Board meetings by streamlining the Board operations, such as by holding preliminary briefings and applying bulk deliberations. |

|

FY2023 evaluation result and issues |

The Company confirmed that the Company's Board of Directors and advisory panels make appropriate decisions through open and active discussions, taking advantage of the diverse expertise, values, and perspectives of its Outside Directors and other members, and that they play an effective role in enhancing corporate value over the medium- to long-term. Regarding the issues recognized in the FY2022 evaluation, we confirmed that progress has been made as shown below. ・Among Key Issues (Materiality), new business (business portfolio), human capital/appointment of women to higher positions, and business in China were selected as the agenda. They were discussed, and progress was confirmed at the Board of Directors meeting. Regarding business in China, we also had a business trip to the country (visiting Chinese business bases, etc.), so we were able to improve our understanding and have discussions ・By holding a preliminary briefing and applying bulk deliberations, we were able to operate the Board of Directors meeting with a more balanced time allocation, and were able to secure sufficient time for agendas that require time for discussion. ・An outside director assumed the position of chair of the Board of Directors and facilitated listening to a wide range of opinions from inside and outside directors, which enabled more lively discussions. The following issues have been identified as needing to be addressed in the future in order to realize the Purpose and sustainable growth. ・Demonstrate more advanced supervisory functions by the Board of Directors ・Achieve more substantive engagement with stakeholders ・Systematic organization of officer training |

|

Future efforts(in FY2024) |

We will continue to review and take necessary measures to maintain and improve the effectiveness of the Board of Directors, improve corporate value, and achieve sustainable growth over the medium to long term, focusing on the following: ・Demonstrate more advanced supervisory functions by the Board of Directors: Strengthening confirmation and supervision of important matters including group governance ・Achieve more substantive engagement with stakeholders: Further enhancement of information disclosure in light of requests for “efforts to realize management with an awareness of capital costs and stock prices" ・Systematic organization of officer training: Organize officer training based on internal, external, and newly appointed personnel; and expand as necessary |

Initiatives to enhance the effectiveness of the Board of Directors

Governance Committee

To further strengthen corporate governance in the Pigeon Group, we established the Governance Committee as an advisory panel to the Board of Directors, chaired by an Outside Director and with a majority of its members being Outside Directors and Outside Audit & Supervisory Board Members. The Committee deliberates on various issues related to corporate governance within the Group that have been identified through the evaluation of the effectiveness of the Board of Directors, etc., from the perspective of promoting organic coordination and integration and proactive implementation, and provides advice and recommendations to the Board of Directors. During the current fiscal year, we reviewed and confirmed the permeation status of the Pigeon Way and Materiality, confirmed the role of the Global Head Office and exercise of its functions, and implemented the evaluation of the effectiveness of the Board of Directors (including consideration of implementation methods and analysis and verification of results).

Voluntary Remuneration Committee, Executive Remuneration System

To increase the independence, objectivity, and transparency of the executive remuneration system, the Company established a Voluntary Remuneration Committee to serve as an advisory panel to the Board of Directors. More than half of the Committee’s members are Independent Outside Directors, and one of these Outside Directors serves as chairman.

The Voluntary Remuneration Committee shall deliberate primarily on the items regarding whether it is necessary to revise the executive remuneration policy, and remuneration levels of individual executives, and provide advice and proposals to the Board of Directors.

Remuneration for Directors (excluding Independent Outside Directors) consists of basic remuneration (based on the position held), bonuses (a short-term incentive), and share-based remuneration (a medium-to-long-term incentive).

In order to further strengthen their independence from management, Outside Directors and Audit & Supervisory Board members receive only basic remuneration and are not eligible for the retirement allowance system.

Please note that executive remuneration, etc. will be paid within the limit of remuneration adopted at the General Meeting of Shareholders.

Voluntary Nominating Committee, Executive Nomination Process

To increase the independence, objectivity, and transparency of the process of selecting and dismissing Directors, the Company established a Voluntary Nominating Committee to serve as an advisory panel to the Board of Directors. More than half of the Committee’s members are Independent Outside Directors, and one of these Outside Directors serves as chairman.

The Voluntary Nominating Committee shall deliberate on issues including the standards for appointment and dismissal of Directors as well as CEO successor plans, and provide advice and proposals to the Board of Directors.

In addition to the human resource requirements of the CEO (responsibilities and authority, main duties and expected results, and required competencies (behavioral characteristics, personality characteristics, experience and achievements, and knowledge and skills)), the executive nomination policy sets out standards for appointment and dismissal, successor plans, terms of office, and the like. The ideal human qualities necessary for the role of Chief Executive Officer (CEO) of the Company are “Human qualities that can enhance resourcefulness and continuously increase the Company’s corporate value (social and economic value), based on the values of the Pigeon DNA and the Pigeon Way.”

Internal Controls

We have established a basic policy on the construction of its internal control systems, based on the Companies Act and its enforcement regulations. The purpose of this basic policy is to ensure the sound and efficient operation of our organizations. Based on this policy, we maintain and operate an internal control system governing the entire group.

We established the Audit Office, an independent organization under the directdirect control of the President, as an internal auditing body. Each year, the Office formulates an audit plan based on a risk approach for the Company and domestic and overseas group companies and conduct internal audits accordingly. In conducting the audits, it focuses mainly on the effectiveness and effi ciency of operations, reliability of financial reporting, compliance, and asset protection, and makes suggestions for improvement as necessary. The results of the audits are shared with all Directors and Audit & Supervisory Board Members at audit report meetings. In addition, the Audit Department established the J-SOX Secretariat to conduct evaluation tests on Groupwide internal controls and the financial process for closing accounts, pursuant to the basic plan for internal controls over financial reporting under the Financial Instruments and Exchange Act, and to monitor the appropriateness of the development and operation of these controls.