Basic Policy

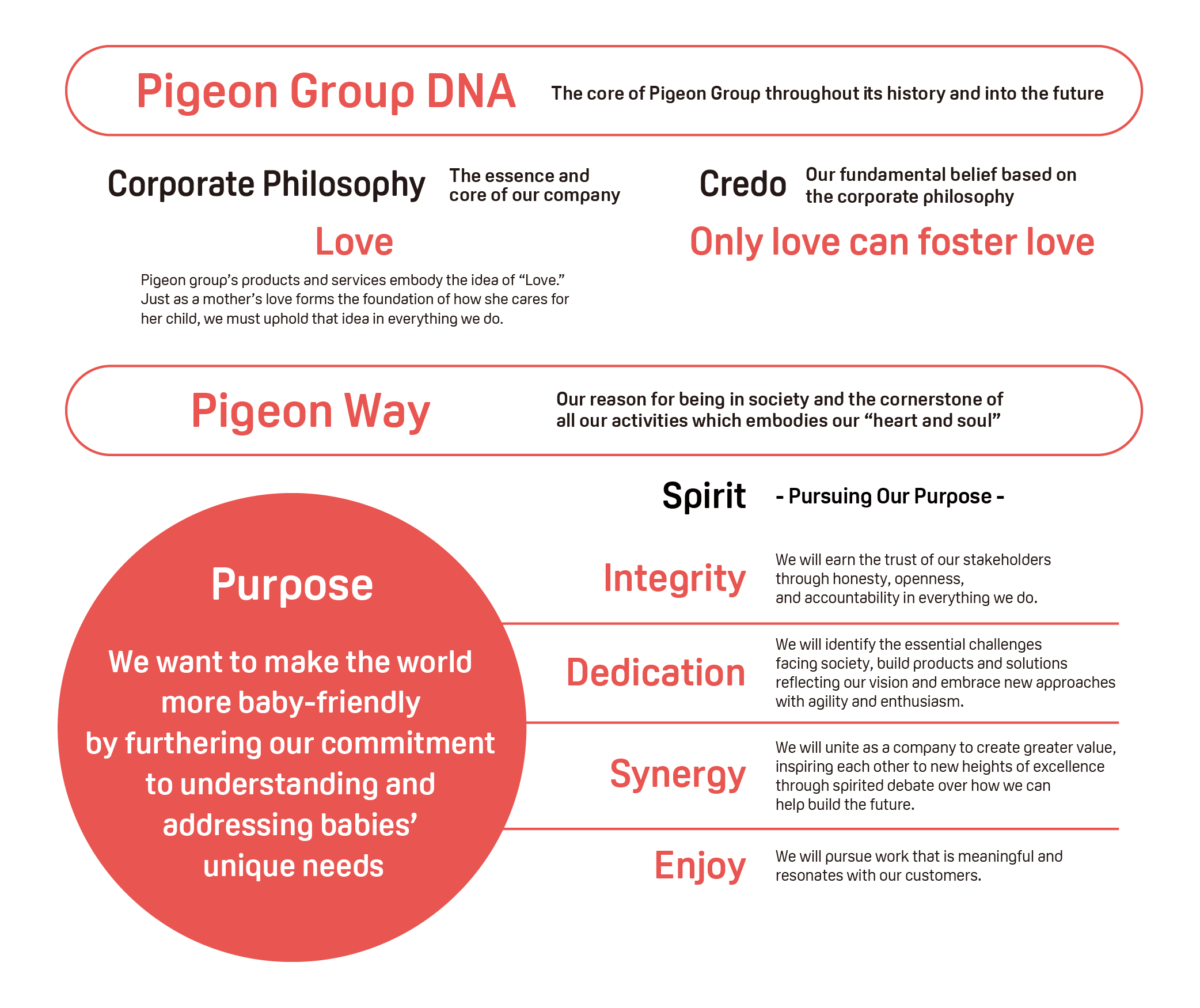

The Pigeon Group DNA and the Pigeon Way

The Pigeon Group DNA consists of our Corporate Philosophy of “Love” and Credo of “Only love can foster love” and has constituted the core of the Pigeon Group throughout its history and will remain so into the future.

The Pigeon Way consists of our Purpose of “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs,” along with our Spirit encompassing the notions of “Integrity,” “Dedication,” “Synergy,” and “Enjoy,” thereby constituting the meaning of our reason for being in society and the cornerstone of all our activities which embodies our “heart and soul.” We have positioned our Corporate Philosophy and Credo as the “Pigeon Group DNA,” which is a concept common to the Pigeon Group, and we have positioned our Purpose as the axis of the Pigeon Way to drive our business activities toward its realization. The Pigeon Group DNA and the Pigeon Way are defined as follows.

Establishment of Materiality (Key Issues)

The Pigeon Group’s “Purpose” cannot be realized solely through the efforts of Pigeon Group employees, but can only be realized through collaboration with external stakeholders, including customers, business partners, shareholders, and local communities. We believe that by realizing our “Purpose,” we can not only continue to exist and be recognized as an “indispensable presence in society,” but also contribute to the realization of a sustainable society.

Therefore, the Pigeon Group has established the following five Key Issues to serve as priorities in its efforts to realize its “Purpose.”

Pigeon's Basic Policy of Corporate Governance

Our corporate governance must be in line with the Pigeon Group DNA and the Pigeon Way, be directed toward solving and realizing Key Issues, contribute to the creation and realization of a sustainable society, and ultimately be directed toward realizing our “Purpose” of “We want to make the world more baby-friendly by furthering our commitment to understanding and addressing babies’ unique needs.”

Based on this Policy, we have defined corporate governance as follows: (1) Offensive governance—a mechanism for transparent, fair, prompt, and decisive decision-making to ensure the Pigeon Group’s sustainable growth and medium- to long-term enhancement of corporate value (social value and economic value), the resolution and realization of Key Issues, and the realization of our “Purpose,” and (2) Defensive governance—a mechanism for risk control through the timely collection and sharing of information and examination and verification, in order to prevent or promptly eliminate factors that may impede the Pigeon Group’s sustainable growth, damage corporate value, or impede the resolution and realization of Key Issues or the realization of our “Purpose.”

By continuously strengthening these mechanisms, the Company aims to further enhance corporate governance, increase corporate value, and ultimately contribute to the creation and realization of a sustainable society, as well as realize our “Purpose.”

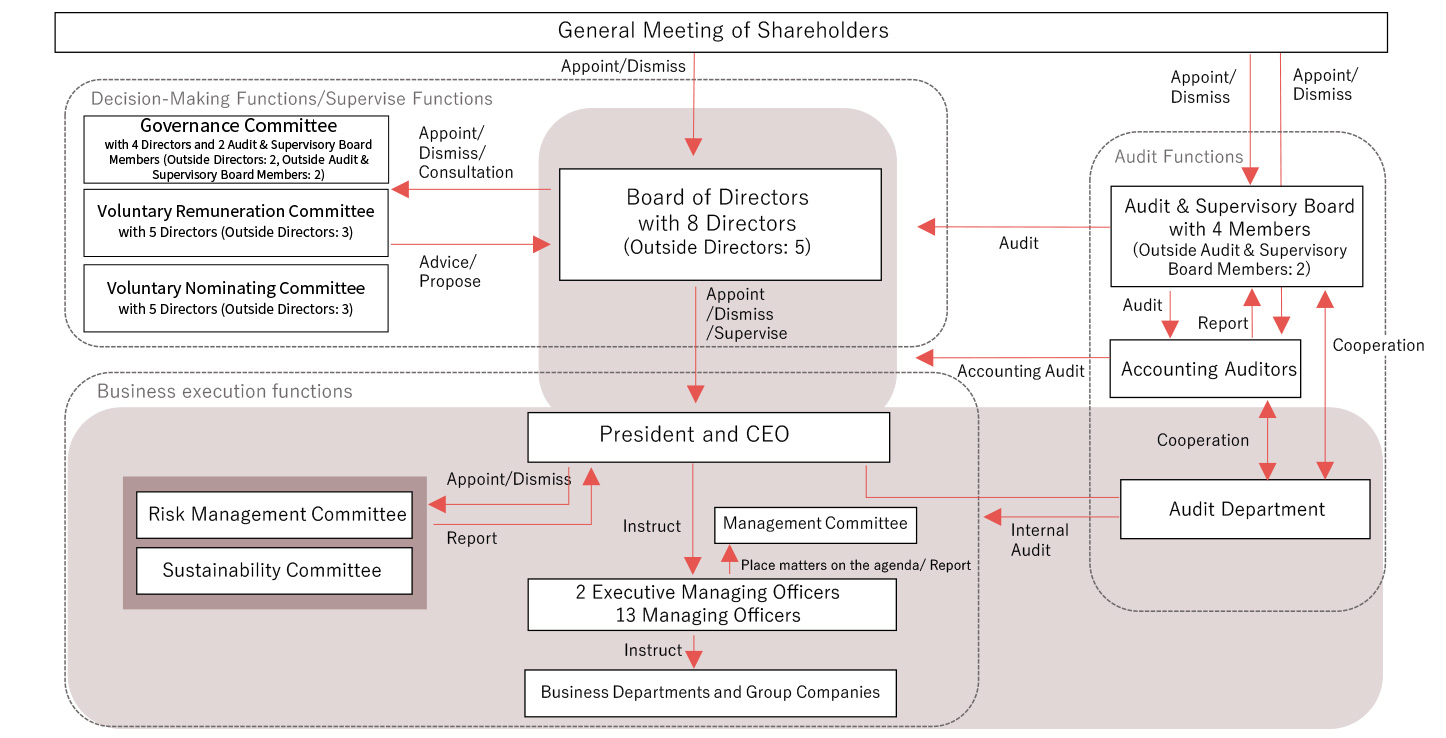

Corporate Governance Organization Chart

Outline of the Governance System

The Company adopts the system of a company with Audit & Supervisory Board Members and has made rigorous legal audits by Audit & Supervisory Board Members the basis of compliance management. The primary management structures (meeting bodies) are: The Board of Directors comprised of 8 members (five men, three women; seven Japanese nationals, one foreign national) including five Independent Outside Directors; the Audit & Supervisory Board comprised of four members (three men, one woman; four Japanese nationals) including two Outside Audit & Supervisory Board Members; Management Committee headed by the President and CEO and comprised of standing Directors and Senior Managing Officers. The Company is working to enhance the diversity of each of the meeting bodies. In addition, the Company adopts a mandatory executive officer system to provide for mutual partnership between decision-making and oversight (governance) with business execution and to clarify the operating responsibilities of Directors.

The Board of Directors makes decisions on matters (management objectives and important business-execution strategies such as the management strategy) prescribed in laws and regulations, the articles of incorporation, and the “Board of Directors Rules” based on its authority to supervise the execution of duties of directors and managing officers. The Board of Directors actively elicits the opinions of Outside Directors and Audit & Supervisory Board Members, and the supervisory function of the Board of Directors has been further strengthened by having an Independent Outside Director serve as Chairman of the Board from March 2023. Further, apart from Board meetings, we hold a meeting on future strategies biannually to eliminate information asymmetry among Directors and Audit & Supervisory Board Members and for them to discuss the Group’s management issues and strategies from a medium- to long-term viewpoint. Also, in addition to the Voluntary Nominating and Remuneration Committees chaired by and with a majority consisting of Independent Outside Directors, we established the Governance Committee as an advisory panel to the Board of Directors. The Governance Committee is headed by an Independent Outside Director and is comprised of a majority of Outside Directors and Audit & Supervisory Board Members.

Audit & Supervisory Board Members attend meetings of both the Board of Directors and the Management Committee, where they deploy their experience in the field to swiftly resolve issues. In addition to enhancing the supervisory function through expression of opinions and the like, Audit & Supervisory Board Members listen to directors, view important resolution documents, examine the current status of business and financial assets, and otherwise conduct meticulous supervision and oversight particularly in accordance with audit policy and segregation of duties. They also meet regularly with the President and CEO, receive reports on matters such as important company issues, and carry out frank exchanges of opinions.

Under the current management structure, centered on the Board of Directors and Audit & Supervisory Board, the Company has been working to improve corporate governance by expanding the diversity of the Board of Directors through the appointment and increase of Outside Directors since 2015, strengthening the supervisory function of the Board of Directors by appointing an Outside Director as the Chairman of the Board from March 2023, establishing advisory panels to the Board of Directors, and active demonstration of supervisory functions by Audit & Supervisory Board Members.

Scope of Judgments and Decisions by the Board of Directors

The Company’s Board of Directors makes decisions or reports on matters that are to be solely determined by the Board of Directors, pursuant to laws and regulations and the Articles of Incorporation, as well as important matters stipulated in the “Board of Directors Rules.” The “Board of Directors Rules” and other internal rules specifically stipulate matters to be resolved by the Board of Directors and matters to be reported thereto.

Related Party Transactions

The Company believes that the monitoring of conflicts of interest is a typical role and function expected of Outside Directors. The Company directly confirms with the Directors and Audit & Supervisory Board Members every six months the existence of important transactions between the Company and its major shareholders, competing transactions between the Company and its Directors or Audit & Supervisory Board Members, conflict-of-interest transactions (self-dealing and indirect transactions) as well as related party transactions, and reports the results to the Board of Directors. In addition, the “Board of Directors Rules” stipulate that a resolution of the Board of Directors is required when engaging in such transactions.

Directors and Management Officers

List of Directors and Management Officers

Skill Matrix

| Name | Position | Expertise demanded of the Board of Directors(*) | Committee members ◎chair 〇member |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Management, business strategy | Experience in the company, industry experience | Global business | Design, R&D, product development | Supply Chain Management | Marketing, branding | Human capital, corporate culture | Finance, accounting | Law, compliance, risk management | Solving societal issues | Nominating | Renumeration | Governance | |||

| Directors | Ryo Yano |

President and CEO | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |||||

| Tadashi Itakura | Director, Senior Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||

| Kevin Vyse-Peacock | Director, Junior Managing Executive Officer | 〇 | 〇 | 〇 | 〇 | 〇 | |||||||||

| Rehito Hatoyama | Outside Director and Chairman of the Board(*3) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||||

| Chiaki Hayashi | Outside Director(*3) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ◎ | |||||||

| Eriko Yamaguchi | Outside Director(*3) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||||

| Yumiko Miwa | Outside Director(*3) | 〇 | 〇 | 〇 | ◎ | ◎ | |||||||||

| Hidenori Nagaoka | Outside Director(*3) | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||||||||

| Audit & Supervisory Board Members | Koji Ishigami | Audit & Supervisory Board Member | 〇 | 〇 | 〇 | ||||||||||

Kazuyuki Tajima |

Audit & Supervisory Board Member | 〇 | 〇 | ||||||||||||

| Koichi Otsu | Outside Audit & Supervisory Board Member(*3) | 〇 | 〇 | 〇 | |||||||||||

| Atsuko Taishido | Outside Audit & Supervisory Board Member(*4) | 〇 | 〇 | 〇 | |||||||||||

*1 A maximum of five main areas of expertise are presented for each person.

*2 The majority of directors are independent outside directors and more than 1/3 are women.

*3 Independent directors based on the regulations of the Tokyo Stock Exchange.

*4 Independent directors who satisfy the requirements for an independent director based on the regulations of the Tokyo Stock Exchange.

Independence Standards and Qualification for Independent Directors

Directors and Audit & Supervisory Board Members also serving as directors, Audit & Supervisory Board Member, and management at other companies

The Company discloses the notable concurrent positions of Directors and Audit & Supervisory Board Members, including Outside Directors and Outside Audit & Supervisory Board Members, in the convocation notice of the Ordinary General Meeting of Shareholders each year and the annual securities report. No limit on the number of concurrent positions allowed is formally set, since the practical manner in which each individual is involved in the roles and responsibilities of a Director or Audit & Supervisory Board Member of the Company is more important. The Company instead indicates the number of meetings of the Board of Directors to be held each year in advance, and schedules the meetings so that members are able to attend.

For specific information on the status of concurrent positions, please click here.

Members and Attendance Status of Board of Directors, Board of Audit & Supervisory, and Committees

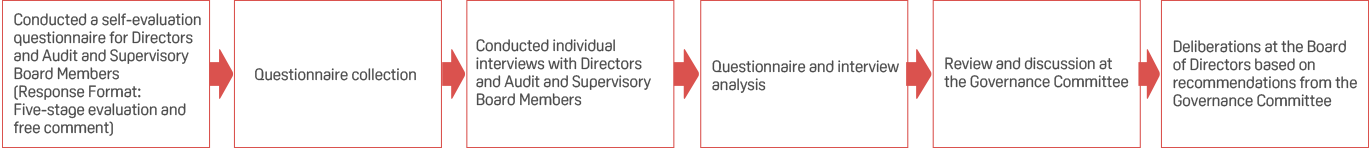

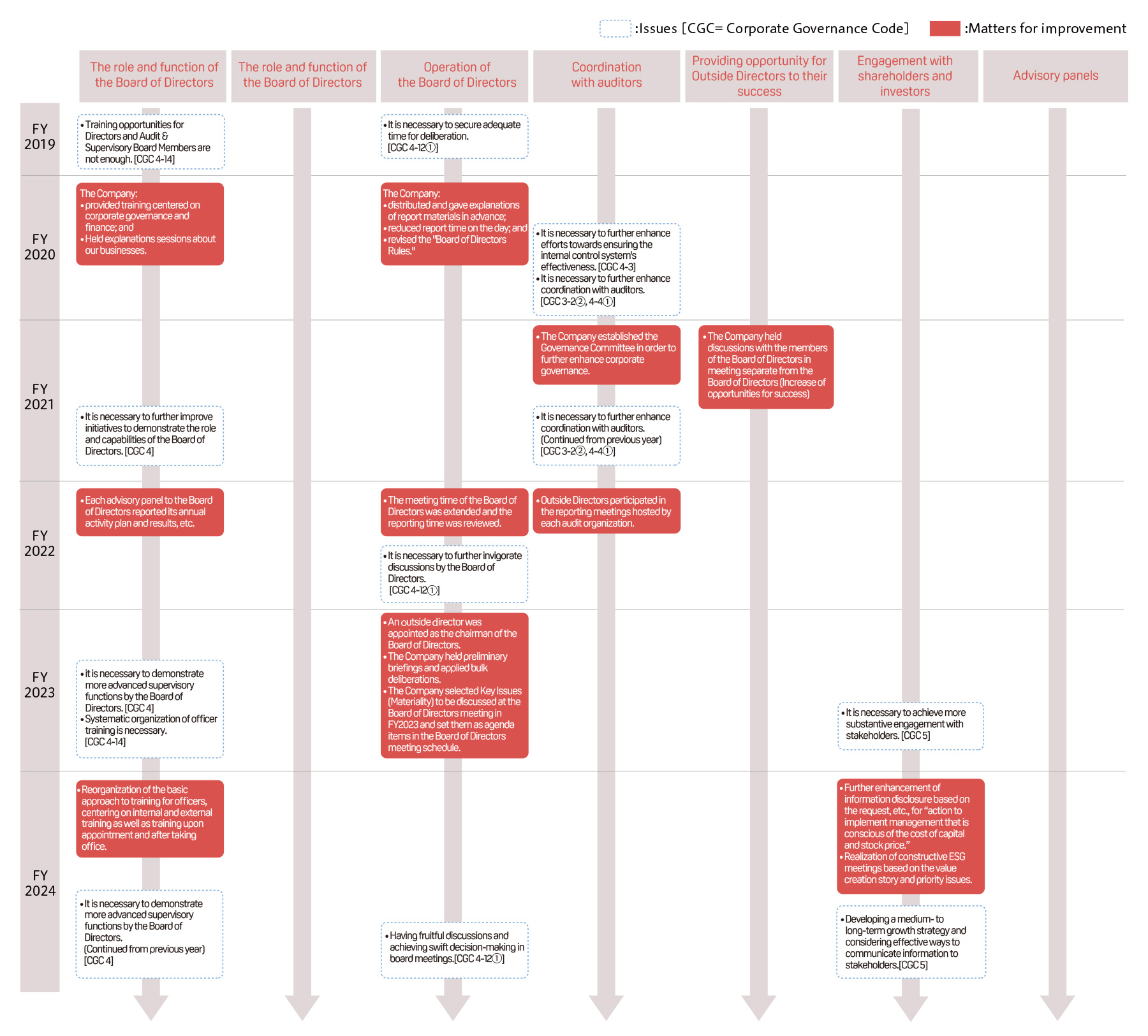

Evaluating the Effectiveness of the Board of Directors

The Company conducts an annual evaluation of the effectiveness of the Board of Directors in order to strengthen it and improve its governance.

Regarding the effectiveness evaluation and analysis methods implemented in FY2024

【Implementation period】Oct. to Nov. 2024

【Respondents】Directors and Audit & Supervisory Board Members (total 13 people)

【Questionnaire items】

Issues from FY2023 and measures taken, FY2024 assessment results and issues, and future measures

|

Issues identified based on the FY2023 assessment results |

Measures taken in FY2024 |

|

Systemizing officer training |

Reorganization of the basic approach to training for officers, centering on internal and external training as well as training upon appointment and after taking office |

| Achieving more fruitful engagement with stakeholders | Further enhancement of information disclosure based on the request, etc., for “action to implement management that is conscious of the cost of capital and stock price,” and realization of constructive ESG meetings based on the value creation story and priority issues |

| Demonstrating a more advanced supervisory function by the Board of Directors | Discussion and consideration on strengthening group governance mainly undertaken by the Governance Committee, and implementation of measures by GHO to improve the business processes of Group companies |

| FY2024 assessment results | |

|---|---|

|

|

Issues identified based on FY2024 assessment results |

Policy for measures to be taken in the future (FY2025) |

| Demonstrating a more advanced supervisory function by the Board of Directors | Strengthen the confirmation and supervision by the Board of Directors of matters centered around group governance |

|

Developing a medium- to long-term growth strategy and considering effective ways to communicate information to stakeholders |

Develop a growth strategy based on discussions in board meetings and future strategy meetings, etc. In addition, consider effective contents and ways to communicate the Company’s corporate value |

| Having fruitful discussions and achieving swift decision-making in board meetings | Enhance the operations of the Board of Directors to facilitate more fruitful discussions and swift decision-making |

Initiatives to enhance the effectiveness of the Board of Directors

Training for Directors and Audit & Supervisory Board Members

All Directors and Audit &Supervisory Board Members will make ceaseless efforts to fulfill their expected roles as Directors and Audit &Supervisory Board Members, and the Company helps them further develop and improve their abilities through the following training support measures.

|

At the time of inauguration |

After inauguration | ||

|---|---|---|---|

|

Directors |

Inside |

Encourage them to participate in external training that will help them deepen the knowledge and understanding generally required of officers for the solution of issues related to management, compliance, corporate governance and others |

(1) Help them deepen their understanding of the Pigeon Group and its businesses through practical training and site visits (2) Provide information and hold training sessions, and also encourage them to participate in external training, with a view to helping them solve managerial issues and deepen their understanding about general situations concerning economy, society, compliance, corporate governance and others |

|

Outside |

(1) Encourage them to participate in external training that will help them deepen the knowledge and understanding generally required of officers for the solution of issues related to management, compliance, corporate governance and others (2) Provide information and have the staff in charge of each business make explanations to help them deepen their understanding of the Pigeon Group and its businesses |

||

|

Audit &Supervisory Board Members |

Inside |

Encourage them to participate in external training that will help them deepen the knowledge and understanding generally required of officers for the solution of issues related to management, compliance, corporate governance and others |

|

|

Outside |

Provide information and have the staff in charge of each business make explanations to help them deepen their understanding of the Pigeon Group and its businesses |

||

Governance Committee

To further strengthen corporate governance in the Pigeon Group, we established the Governance Committee as an advisory panel to the Board of Directors, chaired by an Independent Outside Director and with a majority of its members being Outside Directors and Outside Audit & Supervisory Board Members. The Committee deliberates on various issues related to corporate governance within the Group that have been identified through the evaluation of the effectiveness of the Board of Directors, etc., from the perspective of promoting organic coordination and integration and proactive implementation, and provides advice and recommendations to the Board of Directors. During the current fiscal year, the Committee examined policies and initiatives on human resources and human rights; engaged in preliminary discussions and laid the groundwork for future strategy meetings; explored solutions for addressing instances of fraud in a group company; and implemented the evaluation of the effectiveness of the Board of Directors.

Election, dismissal, nomination and remuneration of Directors and Audit & Supervisory Board Members

In order to ensure a high degree of independence, objectivity, and transparency in the decision-making process for the selection, dismissal, and nomination of Directors and in the design and operation of the executive remuneration system, the Company established a Voluntary Nominating Committee and Remuneration Committee as advisory panels to the Board of Directors. In addition, we believe that it is important to have a system that reflects the opinions and intentions of Independent Outside Directors by having a majority of the committee members consisting of Independent Outside Directors and by having the committee deliberate in an advisory panel independent of the Board of Directors, prior to decisions by the Board of Directors regarding the nomination of Director candidates and compensation of individual Directors, in order to exercise appropriate supervision over individual Directors and the Board of Directors. Based on this concept, the Voluntary Nominating Committee and Remuneration Committee are composed of at least five members, the majority of whom are Independent Outside Directors. In addition, the members of both committees are determined by resolution of the Board of Directors, and the chairpersons of the committees are nominated from among the committees’ members who are Independent Outside Directors and determined by resolution of the committees. The Voluntary Nominating Committee and Remuneration Committee deliberate in consultation with the Board of Directors and provide advice and recommendations to the Board of Directors.

Voluntary Remuneration Committee, Executive Remuneration System

In order to increase the independence, objectivity, and transparency of the executive remuneration system, the Company has established a Voluntary Remuneration Committee as an advisory panel to the Board of Directors. The chairman and the majority of members of the committee are Independent Outside Directors. The Voluntary Remuneration Committee provides advice and proposals to the Board of Directors upon having deliberated on matters that include: governance of executive remuneration; whether it is necessary to revise the executive remuneration policy; remuneration levels of individual executives (base amount by position); performance targets and evaluation table for bonuses and stock remuneration; performance evaluations and individual payment amounts for bonuses and stock remuneration in the previous fiscal year; status of initiatives of the Medium-Term Business Plan and the Key Issues; factors such as level, composition and indicators of executive remuneration using external data and other research; the necessity of response to executive remuneration due to changes in the external environment and business environment; and improving the effectiveness of the Voluntary Remuneration Committee. During the fiscal year under review the Committee examined revisions to the executive remuneration policy; confirmed performance targets and evaluation table for bonuses and stock remuneration; confirmed matters such as performance evaluations and individual payment amounts for bonuses and stock remuneration in the previous fiscal year; confirmed progress associated with indicators of Key Issues for bonuses and stock remuneration; confirmed factors such as level, composition and indicators of executive remuneration using external data and other research; examined improvements of the effectiveness of the Voluntary Remuneration Committee; and examined reductions to executive remuneration accompanying the occurrence of improper transactions in an overseas subsidiary

The remuneration for the Company's Directors (excluding Independent Outside Directors) consists of "basic remuneration" commensurate with position, "bonuses" provided as short-term incentives, and "stock remuneration" provided as a medium- to long-term incentive. The remuneration for Independent Outside Directors and Audit & Supervisory Board Members consists of "basic remuneration" only.

Please note that executive remuneration, etc. will be paid within the limit of remuneration adopted at the General Meeting of Shareholders.

The Company has already abolished the retirement benefits system for Directors.

Against the consolidated net sales target for the fiscal year of 101,000 million yen, the result was 104,171 million yen, and the target achievement rate was 103%. For consolidated operating income, the target and the result were 11,400 million yen and 12,139 million yen, respectively and the target achievement rate was 106%. For PVA, the target and the result were 3,938 million yen and 4,353 million yen, respectively, resulting in the target achievement rate of 111%.

In principle, stock renumeration is given mainly based on performance, which is evaluated 30%, 30%, 20% and 20% on the achievement levels of the following four, respectively: EPS growth rate, TSR, ROIC, and the indicators that are related to the Key Issues (Reducing our Environmental Impact; Contributing to the Resolution of Social Issues; and Managing Talent and Cultivating the Right Culture for our Purpose) and are upheld in the Medium-term Business Plan. With regard to bonuses and stock remuneration, the following table shows the indicators related to the Key Issues and their achievement levels.

|

Renumeration |

Key Issue |

Indicator |

Reason for Selection |

Weight |

Numerical target |

Achievement rate (2023) |

Achievement rate (2024) |

|---|---|---|---|---|---|---|---|

|

Bonus |

Enhancing Business Competitiveness and Resilience |

Increase in the proportion of wide-neck nursing bottles in our product mix |

We have developed high-quality and safe-to-use nursing bottles and nipples based on our research into babies’ milk sucking behaviors. These products provide us with a competitive strength, and expanding our product lineup of wide-neck nursing bottles is key to enhancing our business competitiveness and resilience. |

5% |

Target set by the SBU |

50% |

121% |

|

Establishing Solid Management Foundation |

Maintenance and improvement of ESG scores |

We will increase our corporate value (economic and social value) and enhance the governance system to this end. We have decided to use the ESG scores given to us by external organizations as the indicator, thereby fostering the objective evaluation of our own measures. |

5% |

FTSE: 3.8 or higher MSCI: BBB or higher |

150% |

150% |

|

|

Stock remuneration |

Reducing our Environmental Impact |

Implementation of the Pigeon Green Action Plan |

We believe that implementing the Pigeon Green Action Plan, which aims for “Decarbonization,” “Circular society” and “Coexistence with nature,” will contribute to leaving a rich Earth for the future of babies born tomorrow. |

5% |

Implementation of the Pigeon Green Action Plan |

- |

- |

|

Contributing to the Resolution of Social Issues |

Various support and enlightenment activities on childcare |

Conducting support and enlightenment activities for childcare in various ways will help to solve social issues faced by families raising babies and help them feel pleasure and enjoyment through childcare. |

5% |

Target set by the SBU |

- | - | |

|

Managing Talent and Cultivating the Right Culture for our Purpose |

Improvement of employee engagement |

We attribute the utmost importance to promoting the sharing of our Pigeon Way among all employees and helping individual employees strongly feel that they are contributing to the Company’s Purpose through their work. |

10% |

Average score for the three engagement survey items set by the Company plus 0.1 |

- | - |

Voluntary Nominating Committee, Executive Nomination Process

The Company has established a Voluntary Nominating Committee as an advisory panel to the Board of Directors to enhance the independence, objectivity, and transparency of the appointment/dismissal and nomination processes for Directors. The chairman and the majority of members of the committee are Independent Outside Directors. The Voluntary Nominating Committee deliberates on the appointment/dismissal criteria for Directors and the successor plan for Chief Executive Officer (CEO), etc., and provides advice and proposals to the Board of Directors. During the fiscal year under review, the Committee examined revisions to the Executive Nomination Policy; verified and implemented the CEO successor plan; examined candidates for Directors; reviewed the term of office and tenure of Directors; reviewed the roles of the Chairman of the Board; reviewed revisions to the skill matrix; examined the formulation of a successor plan for Outside Directors; strengthened information coordination between the Board of Directors and the Governance Committee; and examined improvements of the effectiveness of the Voluntary Nominating Committee.

In addition to the human resource requirements of the CEO (responsibilities and authority, main duties and expected results, and required competencies (behavioral characteristics, personality characteristics, experience and achievements, and knowledge and skills)), the executive nomination policy sets out standards for appointment and dismissal of senior management, Directors and the CEO, successor plans for CEO, terms of office of Directors, and the like. The ideal human qualities necessary for the role of CEO of the Company are “Human qualities that can enhance resourcefulness and continuously increase the Company’s corporate value (social and economic value), based on the values of the Pigeon Group DNA and the Pigeon Way.”

Policy and Procedures for nominating candidates for Audit & Supervisory Board Members

Candidates for Audit & Supervisory Board Members are nominated by the Board of Directors and deliberated by the Audit & Supervisory Board. After obtaining the consent of the Audit & Supervisory Board, they are proposed for election by the General Meeting of Shareholders. For Outside Audit & Supervisory Board Members, individuals with high perception of corporate activities such as finance and law shall be nominated as candidates. The majority of these individuals shall be CPAs and lawyers.

*Regarding individual reasons for the election of Directors and Audit & Supervisory Board Members, please refer to the Notice of the Ordinary General Meeting of Shareholders. If a senior management is dismissed, the Company shall disclose the dismissal in a timely and appropriate manner.

Internal Controls

We have established a basic policy on the construction of its internal control systems, based on the Companies Act and its enforcement regulations. The purpose of this basic policy is to ensure the sound and efficient operation of our organizations. Based on this policy, we maintain and operate an internal control system governing the entire group.

As an internal audit function, an Audit Department under the direct control of the President and CEO was established as the Internal Audit Department, which regularly implements internal audits on the Company and its domestic and overseas Group companies from the perspective of confirming operational effectiveness, efficiency, compliance, and asset preservation. Audit results are reported to all Directors and Audit & Supervisory Board Members, and suggestions for improvement and follow-ups are implemented. Furthermore, the Audit Department has established the J-SOX Secretariat, which conducts assessment tests on company-wide internal controls and the process of financial settlement based on the basic plan for internal control over financial reporting under the Financial Instruments and Exchange Act, and monitors the adequacy of maintenance and operation.

Basic Policy for the Internal Control System

Policy on Strategic Shareholdings

Basic Policy

The Company may hold shares as strategic shareholdings, with the aim of improving relations and collaboration with business partners. However, as of the submission date of this report, the Company holds only one stock listed overseas as a strategic shareholding. The Company discloses the purpose and holding status of this strategic shareholding in the annual securities report. Regarding individual strategic shareholdings, the Company confirms the background and objectives of holding the shares, the status of transactions, and risks associated with holding the shares, etc. The Company reviews whether or not shares can continue to be held each year, as well as the number of shares to hold, and obtains approval for strategic shareholdings by the Board of Directors, as a disclosure item of the annual securities report.

Exercises voting rights

The Company exercises voting rights for strategic shareholdings after considering proposals from the perspective of improving the corporate value of the Pigeon Group, while paying due respect to the management policy of the company it invests in.